Custom Private Equity Asset Managers Fundamentals Explained

Wiki Article

All About Custom Private Equity Asset Managers

You have actually possibly come across the term personal equity (PE): buying firms that are not publicly traded. About $11. 7 trillion in possessions were managed by private markets in 2022. PE firms seek chances to make returns that are much better than what can be accomplished in public equity markets. There might be a couple of points you don't comprehend regarding the market.

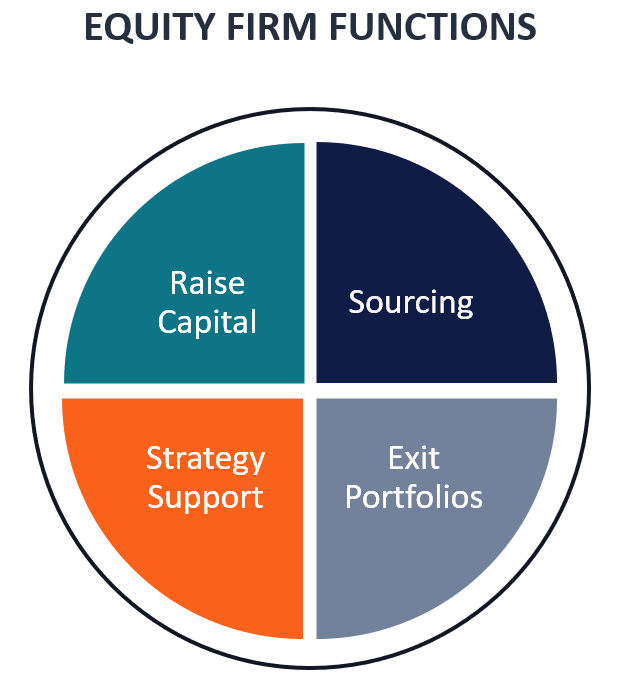

Partners at PE firms increase funds and handle the cash to yield desirable returns for investors, usually with an investment horizon of in between 4 and 7 years. Personal equity firms have a variety of investment preferences. Some are stringent financiers or easy capitalists completely depending on management to grow the firm and generate returns.

Since the finest gravitate towards the larger offers, the middle market is a considerably underserved market. There are more vendors than there are extremely seasoned and well-positioned money professionals with extensive customer networks and resources to take care of an offer. The returns of personal equity are usually seen after a few years.

The Main Principles Of Custom Private Equity Asset Managers

Flying below the radar of large multinational companies, a lot of these small companies typically supply higher-quality customer support and/or particular niche product or services that are not being provided by the huge corporations (https://www.find-us-here.com/businesses/Custom-Private-Equity-Asset-Managers-Abilene-Texas-USA/33950041/). Such upsides draw in the rate of interest of private equity firms, as they possess the insights and smart to manipulate such chances and take the company to the following level

A lot of managers at profile firms are given equity and reward payment structures that reward them for hitting their monetary targets. Private equity possibilities are usually out of reach for individuals that can not invest millions of dollars, yet they should not be.

There are guidelines, such as limitations on the aggregate amount of cash and on the number of non-accredited capitalists. The private equity service attracts a few of the very best and brightest in company America, including top performers from Lot of money 500 business and elite management consulting companies. Law office can additionally be recruiting premises for exclusive equity works with, as accounting and lawful abilities are essential to complete deals, and transactions are extremely sought after. click here to find out more https://holistic-hockey-df2.notion.site/Unlocking-Wealth-Exploring-Private-Investment-Opportunities-with-Custom-Private-Equity-Asset-Manage-9a6dee69d573415d908b1abc0221059b?pvs=4.

Rumored Buzz on Custom Private Equity Asset Managers

Another downside is the absence of liquidity; once in an exclusive equity purchase, it is not simple to get out of or offer. With funds under monitoring already in the trillions, personal equity firms have ended up being appealing financial investment cars for well-off people and establishments.

Currently that access to personal equity is opening up to even more individual capitalists, the untapped potential is becoming a truth. We'll begin with the primary debates for spending in private equity: Exactly how and why personal equity returns have actually historically been higher than other assets on a number of degrees, Just how consisting of personal equity in a profile impacts the risk-return profile, by aiding to expand against market and intermittent danger, After that, we will detail some vital factors to consider and threats for private equity capitalists.

When it comes to introducing a new asset into a portfolio, one of the most basic factor to consider is the risk-return account of that possession. Historically, private equity has shown returns similar to that of Emerging Market Equities and higher than all other standard property classes. Its fairly reduced volatility coupled with its high returns creates a compelling risk-return profile.

Some Known Questions About Custom Private Equity Asset Managers.

Actually, exclusive equity fund quartiles have the best range of returns throughout all alternative possession courses - as you can see listed below. Technique: Interior rate of return (IRR) spreads out computed for funds within vintage years independently and after that averaged out. Average IRR was computed bytaking the average of the mean IRR for funds within each vintage year.

The result of adding exclusive equity right into a profile is - as always - reliant on the profile itself. A Pantheon research from 2015 recommended that consisting of private equity in a profile of pure public equity can unlock 3.

On the other hand, the best personal equity firms have access to an even bigger pool of unidentified opportunities that do not face the same analysis, along with the resources to carry out due persistance on them and identify which deserve investing in (Private Equity Firm in Texas). Investing at the first stage suggests greater risk, however for the business that do succeed, the fund take advantage of higher returns

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Both public and personal equity fund supervisors devote to spending a portion of the fund yet there continues to be a well-trodden issue with straightening passions for public equity fund monitoring: the 'principal-agent trouble'. When an investor (the 'principal') hires a public fund supervisor to take control of their resources (as an 'agent') they hand over control to the manager while preserving ownership of the assets.

In the situation of exclusive equity, the General Companion doesn't simply gain a monitoring charge. Personal equity funds additionally mitigate one more kind of principal-agent issue.

A public equity capitalist ultimately desires one thing - for the administration to boost the supply price and/or pay rewards. The investor has little to no control over the choice. We revealed over the number of personal equity strategies - particularly bulk buyouts - take control of the operating of the firm, ensuring that the lasting worth of the firm comes first, pressing up the return on financial investment over the life of the fund.

Report this wiki page